With the start of the new year there are a few things that everyone always talks about: getting in shape, organization and finances. None of them are my favorite topic and I am not good all three. But I keep trying and that’s gotta account for something, right? I gathered five ways to get your budget under control.

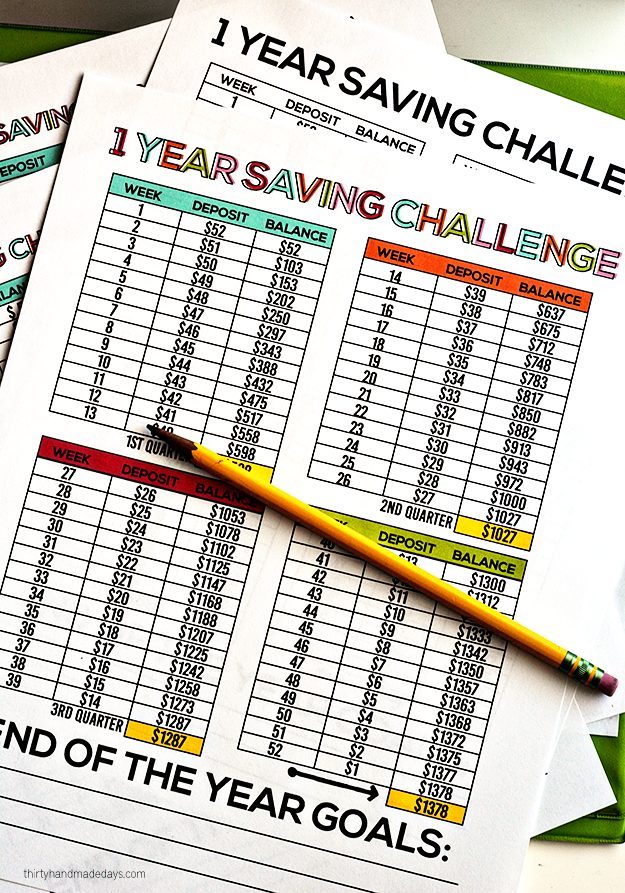

Oh budget binder how I love thee. There has been a lot of debate about this picture. Yes, there are spots for 4 credit cards on here. The fact is, a lot of people in America (and elsewhere) have many more than 4. The idea is to pay all of them off. And if you already have or never had a credit card to begin with – you are awesome!! I mean it. Either way, this is meant to make you accountable for your finances and to get you on the right track with your budget.

Have you heard of the envelope system? There are tons of posts out there about this but I really like One Good Thing by Jillee’s. The envelopes are cute with a template and she has money tips on it too.

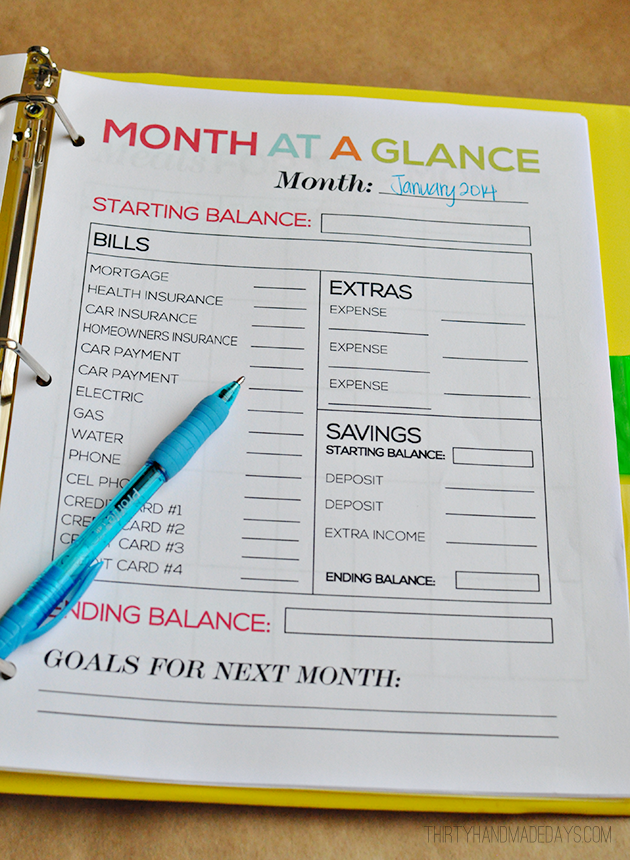

Just recently I posted about the One Year Savings Challenge. Have you joined in? It’s pretty simple and self explanatory but just another way to gain control of your finances and set aside money for savings. I included a kid version in there too because I think it’s super important to teach your kids (grandkids, students, etc) about money.

Organize your meals! I don’t know about you but food is a big bulk of where our money goes each week. By planning and making ahead, you can save a huge amount of money. This post has awesome crockpot make ahead meals that don’t break the bank! Also check out Beth’s recent Freezer Meals 101 post for how to make a bunch of meals to use throughout the month and avoid eating out.

I stumbled across this idea and love it! The Budgeting Mama explains how to develop a make or break price for products. This helps price compare at different stores. She includes a printable for it too!

So I’d love to hear from you how you get on track with your budget and finances. Leave your tips below!

Thank you for sharing this! I went to your original blog post and downloaded the sheets! My husband and I have been working on becoming credit card debt free and really budgeting our money. The past 3 months have been pretty amazing seeing where we can save! I am obsessed with binders as well, so that is right up my alley! :)

It’s because of our own journey learning to save money in hard times I started Frugal Living Mom to help people find things that they could get for free and put “frugal strategies” into their everyday lives. I use some apps for keeping track of my finances and I do zero-sum budgeting as well with the help of a spreadsheet. Help me a lot to save money and make sure I don’t spend on unnecessary things.

We are finally starting to manage all of our debt. This month, I just paid off my last credit card from the 9 (yes, NINE) that we had equaling about $30,000 in debt. We had to make some hard choices to do it, and we are by no means done with debt (I have EXTENSIVE student loans) but that one victory has given me hope that we are well on our way! Thanks for your roundup of tips, I’m always looking for great ideas to add to my debt-management system! :)

We have some debt but I think we will get it paid off this year. Our one car payment is gone Friday. Yeah. That means that amount will help the other debt go down faster. I use the envelope system loosely. My husband gets a certain amount of cash each week and so do I. I only take cash for groceries. It helps me not pick up too many extras. Another thing that helps is if I add each item as I go thru the store so I have a good idea what my total will be. (That only works if my phone is not dead!) I do have a Christmas Club account that is taken out of my checking account each week and it just keeps going year after year. Since our family keeps growing, 13 grandchildren now, I have been trying to add extra to the Christmas Club on a monthly basis so we have enough when we need it. I have also set up a savings plan where a set amount comes out of checking each week into 2 savings accounts. One is for our emergency fund and the other is just a general savings. Also have 1/4 of our mortgage payment taken out of checking and put into savings each week and then every other week a half payment is made to our mortgage. I like having these set up like this so it automatically gets done, even when on vacation. Never late on a mortgage payment. Not every bank will allow half payments every two weeks but mine does. We have one credit card that is for gas only, and we love when we get a $25 card to use, free gas. Really need to get into the price book. There are times when I know I could probably get something cheaper somewhere else but just don’t want to take the time to go somewhere else.

About 8 years ago, I realized that we REALLY needed to get a handle on our finances. We had $30,000 in CC debt and I couldn’t see a way out in this lifetime. FF 8 years. It has NOT been easy but we paid off all that debt!! We went from 1 to 4 kids and I’m SAHM. Up until now, having any kind of savings seemed impossible. So this year is the year for getting our emergency fund, funded :) I worked on our budget a few weeks ago. Here’s what I did: I typed up our budget. I leave the money in our account that is auto withdrawal or paid via our bank bill pay system. The rest is pulled out and we use the envelope system. I made a special wallet with four zipper “envelopes” and I use that for our every day spending: gas, groceries, spending. Then I put together my own binder where I stapled the budget breakdown to the inside of a file. It includes how much cash needs to be taken out from each check (paid every other Friday). Each paycheck is divided slightly differently so I have those numbers included in the budget breakdown sheet. Also in this budget binder are the rest of the envelopes: savings, vacation, gifts, clothing, auto maintenance, & home improvement. Each Friday that my husband is paid, I pull out the binder to double check the cash amount and then disperse it among the envelopes. It is working ‘so far’! We’ll have to see how we’re sitting this time next year!! I also grocery shop twice a month. I went to this about 6 months ago and it has REALLY helped me stick with our budget!! I imagine shopping just once a month would help even more :)

Julie I am very interested in your system! I think it would work very well for me. I would love to know more!

Sure :) Do you mind emailing me? I can send you a couple photos that way and explain better. My email is [email protected] I would be happy to answer your questions :)

I don’t use a credit card (not very common in Belgium) but I’ve always been very bad at saving money so I started this method: every month (we get paid on a monthly basis) I do an estimation of how much my bills will be,including gas/food/clothes for baby etc,I keep that amount on my debit card and the rest I transfer to my savings account. When I run out of money I have to log in to my account and transfer money and I then see my savings decreasing. This helps me visualize how much I’m spending and keeps me motivated to have a high balance on my savings account. It helped me save almost half of my salary every month!

Thank you!

I really like the idea of a price book. I’ve never used one before but I think I might start as I’ve notice a couple of products have different prices at different Aldi stores.

It could be an interesting exercise to track the price based on suburb. If I can get myself into the routine of shopping monthly a longer trek could be worth it.

Cheers!

Love the separate money envelopes! Great ideas!

Great timing! Thanks, Mique! XO